Dear Clients & Friends,

If you spend even a few minutes with the news cycle today, it can feel like uncertainty surrounds us at every turn. Political divisions. Geopolitical tensions. Economic crosscurrents. Election rhetoric. Relentless commentary.

The volume is high. The tone is urgent. And the narrative often leans negative. But it is important to pause and remember something essential: the businesses you own do not operate on headlines.

They operate on innovation. They operate on productivity. They operate on human ingenuity and disciplined execution. And those forces have proven remarkably durable over time.

A Century of Volatility — and Progress

Over the last 100 years, investors have lived through extraordinary challenges:

- The Great Depression

- World War II

- The Cold War

- Oil embargoes

- Double-digit inflation

- The tech bubble

- The Global Financial Crisis

- A Global Pandemic

Each of these periods felt uncertain — even frightening — in the moment.

Yet through it all, the long-term trajectory of productive enterprise has been upward.

Since 1926, the S&P 500 has delivered an average annual return of approximately 10%. What surprises most investors, however, is that the market rarely earns anything close to 10% each year. Annual returns have ranged from gains exceeding 50% to declines greater than 40% (source: Bloomberg).

That is volatility. But volatility is not a flaw in markets. It is the mechanism through which long-term returns are earned.

The Healing Power of Time

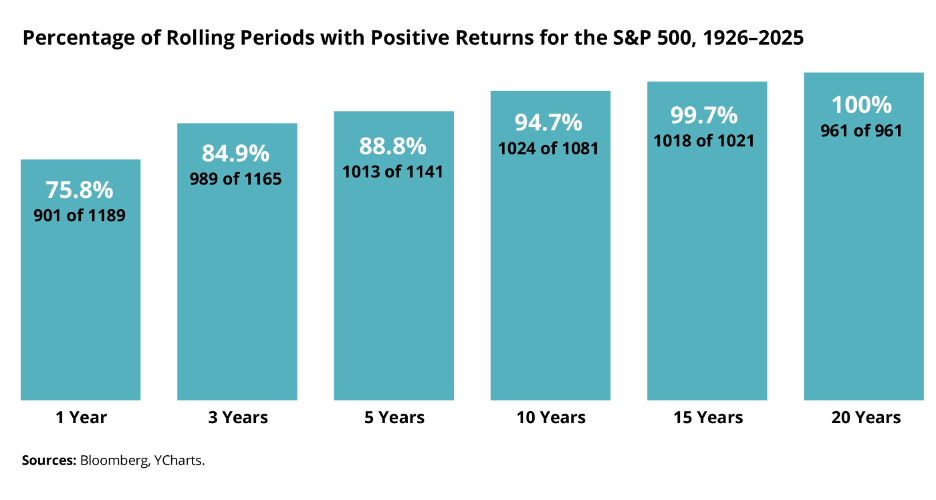

When we examine rolling periods of market history — nearly a century of data — something powerful becomes clear:

- 1-year periods were positive about 76% of the time

- 3-year periods were positive roughly 85% of the time

- 5-year periods were positive nearly 89% of the time

- 10-year periods were positive about 95% of the time

- 15-year periods were positive nearly 100% of the time

- 20-year periods were positive 100% of the time

(Source: Bloomberg, YCharts)

Time does not eliminate volatility. It overwhelms it.

The longer the investment horizon, the greater the historical probability of a positive outcome. That is not optimism — that is evidence.

Strength Beneath the Headlines

Today’s environment may feel unsettled. But uncertainty has always been present. It simply changes its costume. Meanwhile, the companies you own continue to innovate at extraordinary speed, deploy capital efficiently, expand into new markets, leverage emerging technologies, and adapt to shifting economic and political conditions.

Markets do not rise because the world is calm. They rise because human progress continues. The greatest businesses in America and around the globe have endured wars, recessions, policy shifts, and global crises. They have adapted. They have evolved and they have grown. That resilience is not temporary. It is structural.

Our Framework: Goals → Plan → Portfolio

At Mercer Partners, our discipline remains unchanged. We begin with your goals. We engineer a thoughtful financial plan. And we use a diversified portfolio of productive businesses to power that plan forward.

We do not build portfolios around election cycles or quarterly headlines. We build them to endure. Short-term volatility is the price of admission for long-term growth. The evidence strongly suggests that those who stay invested — and stay disciplined — dramatically increase their probability of success.

A Word of Reassurance

If today’s environment feels noisy, that is normal. If markets fluctuate, that is normal. But history offers a powerful lesson: over time, equity investing has demonstrated an extraordinary capacity to heal, recover, and progress.

Your portfolio is built on resilient businesses. Your plan is designed for durability. Our role is to help you stay aligned with both — especially when emotion tempts deviation. The headlines will change. Volatility will continue. But human ingenuity, productivity, and enterprise have endured for more than a century. We believe they will continue to do so.

As always, thank you for being our clients. It’s our privilege to serve you.

Best,

Nick

These views are those of the author, not of the broker-dealer or its affiliates. This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. All investments involve risk, including loss of principal. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. Indexes are unmanaged and cannot be invested in directly.

No investment strategy can guarantee a profit or protect against loss in periods of declining values. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Mariner Independent Advisor Network, a registered investment advisor. Mariner Independent Advisor Network and Mercer Partners Wealth Management are separate entities from LPL Financial.